April 16, 2012 at 7:48 am Impact Entrepreneurs at Portland State University

By Jacen Greene, Ames Fellow for Social Entrepreneurship at Portland State University

Impact Entrepreneurs?at Portland State University and Ater Wynne LLP are co-hosting an impact investing panel?the morning of April 19. The panel, moderated by Cindy Cooper of Impact Entrepreneurs, will feature Kipp Baratoff of Meyer Memorial Trust, Bill Campbell of Equilibrium Capital, and Patrick Maloney of Imprint Capital. If you?re an entrepreneur, investor, or foundation interested in investment for blended social, environmental, and financial return, you should consider attending (register here). If you?re unable to attend, have no idea what we?re talking about, or (gasp!) reading this in the future and missed the event, don?t worry: we?ve got you covered with a short primer on impact investment.?

Impact Investing: a Definition

Antony Bugg-Levine and Jed Emerson, who respectively coined the phrases ?impact investing? and ?blended value,? provide a succinct definition in their new book Impact Investing:

Impact investors intend to create positive impact alongside various levels of financial return, both managing and measuring the blended value they create.

We can unpack this statement to reveal four key items: positive impact, intention, management, and measurement. An impact investment is intended to generate positive financial, social and environmental outcomes.?Accidental good that results from an investment decision isn?t part of impact investing; the positive impact must be intentional. Management requires an active involvement in investment decisions?no blind trusts here. Finally, accurate measurement is key to verifying, replicating, and scaling impact. Good intentions alone aren?t enough.

A Brief History of Impact Investing

The field of impact investing has a storied history, from Quaker prohibitions against profiting from slavery, to anti-apartheid boycotts, to the modern microfinance and?social enterprise movements. The nonprofit Acumen Fund was an early pioneer in making investments to support businesses that generate a positive social and environmental impact.?Only recently, however, was the term ?impact investing? coined to unify these seemingly disparate approaches. The field gained further definition with the publication of impact investing reports by the Monitor Institute and J.P. Morgan.

Bill Campbell,?Principal and CFO of Equilibrium Capital Group, describes the evolution of impact investing and its intersection with socially responsible investing:

We think of socially responsible investing (SRI) as the first generation of impact investing?don?t invest in ?bad actors,? where bad actors tended to be identified with particular causes (e.g., apartheid). SRI was impact investing 1.0. Initially it carried the premise that responsible investors should be willing to forego returns?[the choice was] returns OR impact.

More recently impact investing has broadened out; mainstream practices now assert that one should affirmatively select ?good actors.? Good actors are known for following best practices in their Environmental, Social, and Governance (ESG) policies.? ESG investing is impact investing 2.0; it encompasses SRI as a subset. In general it asserts that ?good actors? allow investors to get returns AND impact.

We are pursuing a category of investing we think of as impact investing 3.0?returns FROM impact. Our premise is simple: by identifying business models that are more profitable because they have found how to monetize the value of positive impact, and creating financial products that express that value for investors.

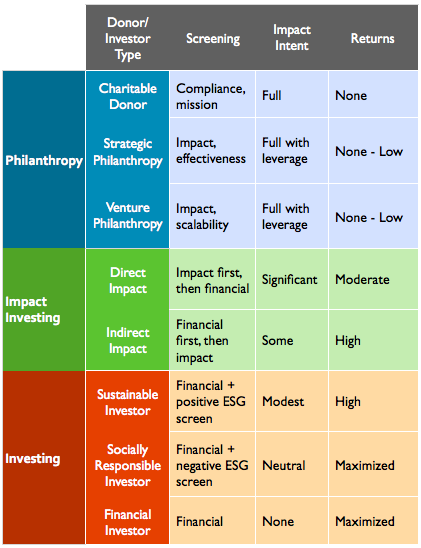

Not all impact investors believe that impact investments can, or should, be as profitable as other investment opportunities. A central debate in the community is whether greater social impact can be achieved by accepting a lower rate of return, as business revenue is reinvested in scaling impact rather than paid out to investors.?(See ?Impact Investment Spectrum? diagram below).

Bugg-Levine and Emerson argue for the concept of ?additionality,? which ?calls on investors to target businesses that would not otherwise be capitalized by private investors,? thereby enhancing impact. In this way, clean energy and debt capital (such as microfinance) may no longer be significantly impactful, given the increasing willingness of traditional investors to participate in those sectors.

Measuring and Making Impact

To be considered truly successful, an impact investment must generate not only financial returns, but also significant social or environmental benefits that can be directly attributed to the activities of the organization receiving the investment. Accurate measurement thus becomes critical, but the vast diversity of investees made comparing impact across sectors prohibitively difficult. The Global Impact Investing Ratings System?(GIIRS),?created with that need in mind, now provides one possible solution for measurement and reporting. A detailed questionnaire generates a numerical score for each participating organization, with random audits ensuring accuracy. A number of organizations have formally adopted the system, and the first GIIRS analytics report was issued earlier this year.

So?how can you become an impact investor? Microplace offers retail investors access to a range of both domestic and international impact investment notes, with minimum investments starting as low as $20.?The?RSF Social Investment Fund?targets U.S. and Canadian organizations, and requires a minimum investment of $1000. If you?re an accredited investor?i.e., wealthy?the?Global Impact Investing Network?s?ImpactBase?provides access to data on impact investment funds and products.?The recently-signed JOBS Act will enable businesses to offer shares to investors without being listed on a stock exchange, providing an opportunity for social entrepreneurs?businesses created to generate significant, positive social and environmental impact?to raise money directly from the public.

To learn more, sign up for the April 19, 2012 PSU Business Briefing Breakfast panel on impact investing, or follow some of the links above and explore the rapidly expanding, globally transformative field of impact investing.

Impact Investment Spectrum, based on materials by Brian Walsh, Scott Lawson, and Laurie Lane-Zucker.

Like this:

Be the first to like this post.

Entry filed under: Events. Tags: Equilibrium Capital, ESG, impact entrepreneurs, impact investing, impact investor, Imprint Capital, Meyer Memorial Trust, retail impact investing, social enterprise, social entrepreneurship, social innovation, SRI.

iowa caucus dick clark lemonade diet steve jobs action figure chris jericho rose bowl johnny weir

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.